I originally wrote this for @KevinPorter, but I realized that these were questions (and misunderstandings) that I heard a lot. So this is a (very) brief overview of my understanding of Keynesian thought, along with some of it’s problems at the end. It’s not meant to be definitive – or a complete excuse for all government spending. It’s an attempt to outline the basic ideas in relatively accessible language. I hope you find it interesting.

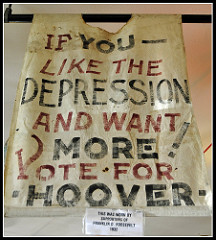

Keynes is best known for the economic policies that were part of the New Deal. That alone is enough to vilify him for some conservatives, but that is not a criticism of Keynes’ theories, much less of the new Keynesians. The latter especially are a diverse lot, and I cannot pretend to speak for all of them. Despite these shortcomings, I am going to take a stab at summarizing the basic ideas and principles of Keynesian thought as well as some of the difficulties this theory faces.

Keynes is best known for the economic policies that were part of the New Deal. That alone is enough to vilify him for some conservatives, but that is not a criticism of Keynes’ theories, much less of the new Keynesians. The latter especially are a diverse lot, and I cannot pretend to speak for all of them. Despite these shortcomings, I am going to take a stab at summarizing the basic ideas and principles of Keynesian thought as well as some of the difficulties this theory faces.

It is sometimes difficult to remember that bank runs and depressions were a relatively common occurrence before the Great Depression. Business cycles staggered between large booms and large busts. Keynes hoped to stabilize this cycle for entire economies, by smoothing out both the booms and the busts. Conservative and Chicago school economists will tell you that government is a drain on the private sector of the economy – and they are not wrong in this. What Keynesians want to do is to utilize that drain in a smart and efficient manner.

Imagine driving along a ridgeline – up and down, up and down. When the hills are steep enough, it can be really tough getting up the far side – especially when you have 4-cylinder cars like my last two! What you have to do is pick up enough speed going downhill so your momentum helps get you up the far side.

Likewise, in a boom time, governments should be more aggressive about cutting spending, and raise taxes. This keeps the boom from getting out of control. In the bust part of the cycle, government spends and lowers taxes. Lowering taxes then allows for more private spending to get out of the bust, and the government spending should prime the private sector pump.

There is controversy among self-styled Keynesians about how government spending should happen. Should it be handouts (such as the cash tax rebates that George W. Bush enacted)? Or should it be in infrastructure development, like the TVA? A mix of the two? Or perhaps in additional incentives for private purchases – like the tax credits for getting a more gas-efficient car? These are highly debated, and you’ll get different answers from different economists. Personally, I am a fan of infrastructure development and programs that increase human capital and make the market freer.

For example, providing reliable transportation is one of the best single actions anyone can take to help the poor. Many poor people are geographically isolated. Public transportation to areas with jobs can be extremely time-consuming; it would take an hour on a bus (and that much again in a walk) to get from downtown Dayton to the Greene, for example. Driving, it takes about 15 minutes. It would be worse on weekends – the buses run less frequently. Providing transportation makes that person’s ability to get a job much better.

Likewise, training programs, aid for childcare while people work, and making the transition from welfare-to-work much more gradiated would all be useful ways to increase ability for people to work. Likewise, infrastructure developments – high-speed internet, fixing roads, hiring more fire and police officials – can also make an area more productive in the long run.

There are a few problems with this theory when it hits the real world.

First, there is a time-gap problem. We only know where we are in the business cycle after the fact – and then getting legislative solutions passed takes even longer. After that, there’s an even further delay before the funds are spent. By that time, it is possible that we would already be recovering from a downward turn and cause the economy to overheat. This problem is lessened somewhat by increased transparency and the speed at which information is collected and disseminated.

Secondly, and perhaps more problematic, is that spending rarely stops during an upward turn. Whether speaking about government programs or even private charities, once a program is begun, it usually stays in place. The March of Dimes, for example, accomplished its original mission decades ago. Similarly, there are government programs which are not accomplishing their mission, or the original mission ended a long time ago. They all may have done positive things for society – but have switched from a stimulus to a drain on the economy.

Finally, I alluded earlier to the method of spending the money. The Keynesian multiplier is a factor economists use when talking about spending money. A simplistic example would be choosing to buy something made by a neighbor instead of by someone in China. That neighbor might then spend that dollar you just paid buying something from you or someone in your region. The person in China cannot – they’ll spend it in their own economy. If your stimulus money ends up flying out of your economy, it’s done less good than someone buying Kentucky whiskey!

That’s a very simple example, but it highlights some of the things that should be considered (and may not be!) when talking about government spending. How effective the programs are, how much bureaucracy is needed, and how much is wasteful are all things we can reasonably debate. We can even discuss CEOs and executives who spend their corporate welfare on creature comforts instead of the corporation. These, however, are arguments about execution, not about the theory itself.